The WhenFresh Decisions-as-a-Service suite enables Mortgage Lenders to make faster, better-informed decisions through the full mortgage lifecycle.

12th December 2022

WhenFresh is the UK’s Residential Property Data Bureau and provides Mortgage Lenders with instant access to all the data they need to make faster, better-informed decisions throughout the full mortgage lifecycle, from initial application tight through to securitisation.

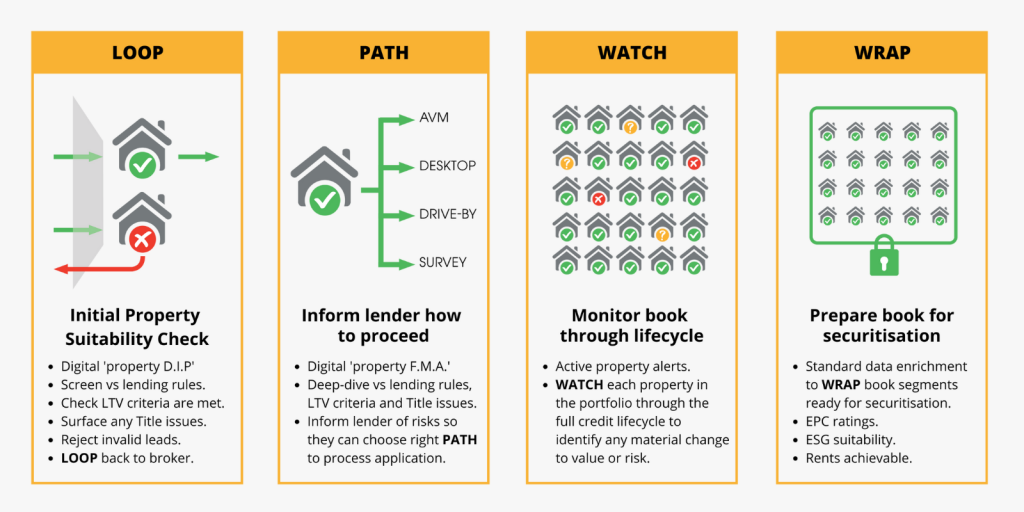

WhenFresh Decisions-as-a-Service provides instant, remote property risk assessment – complementing the credit bureau services which assess consumer credit risk – and is delivered via a suite of 4 modules:

LOOP – Equivalent to a digital ‘Property D.I.P.’ whereby each new mortgage application is instantly and remotely screened against lending rules, LTV criteria and Title issues. Typically 5-10% of applications are rejected at this stage and ‘loop’ back to the broker/applicant(s), before the lender has invested money and resource processing applications which would fail at a later stage.

PATH – Equivalent to a digital ‘Property F.M.A.’ this deep-dive, data-driven triage evaluates the property, valuation and title to assess current/future risk and inform the lender which ‘path’ to choose. This separates the 60-80% of properties where an AVM will be sufficient to move to an immediate mortgage offer, from the 20-40% where a desktop, drive-by or full physical survey of the property will be required.

WATCH – Live alerts across the portfolio to flag any issues which may impact each property’s value or risk.

WRAP – Property data enrichment to prepare & segment a mortgage book for optimum securitisation.

Each module can quickly and easily be tested against any lenders existing processes – so please click here to find out more and to book a call/demo.

Landbay partners with property data provider WhenFresh to speed up underwriting

13th February 202413th February 2024: Buy-to-let lender Landbay has announced a new partnership with leading property data provider WhenFresh, a PriceHubble company, to assist and speed up its underwriting process. WhenFresh brings together more than 200 proprietary, private and public datasets, including sources such as environmental, geographical and market data, to determine property attributes and risk. WhenFresh […]

Coventry City Council Enjoys 95% Success Rate With WhenFresh Unlicensed HMO Targeting Solution

2nd January 20242nd January 2024: The licensing of HMOs (Homes of Multiple Occupancy) is a ‘hot topic’ for Councils up and down the country, where potentially significant revenues from undeclared and therefore unlicensed HMOs are lost and unscrupulous landlords are failing to comply with their statutory obligations. To meet this challenge, WhenFresh has developed an innovative unlicensed HMO […]

Accessible EPC (Energy Performance Certificate) Data from WhenFresh

27th September 2023September 2023 – As well as being a regulatory requirement in certain sectors, the EPC (Energy Performance Certificate) rating data for any individual property (or a full mortgage book, for example) can be a key indicator to current and future risk, condition and value. EPC ratings are also important in the context of ESG and […]