MortgageChecker

The instant “traffic light” triage solution, which informs UK mortgage lenders of whether & how to proceed based on their specific lending rules and LTV criteria.

MortgageChecker Overview

In short, MortgageChecker is the new data-driven “triage" solution from WhenFresh, which enables residential lenders to instantly and remotely screen new mortgage applications against any set of lending rules and LTV criteria, to decide how they should be processed.

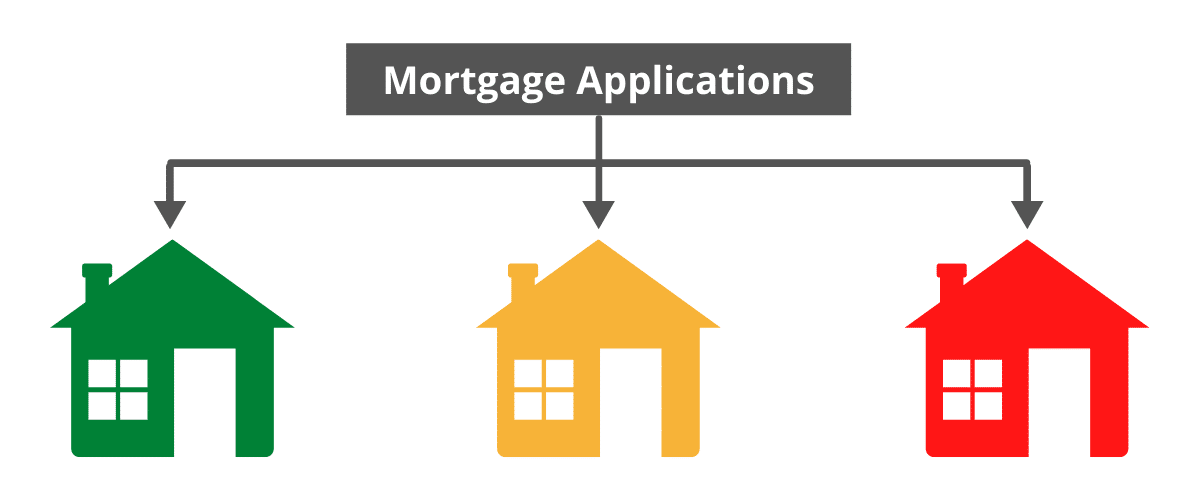

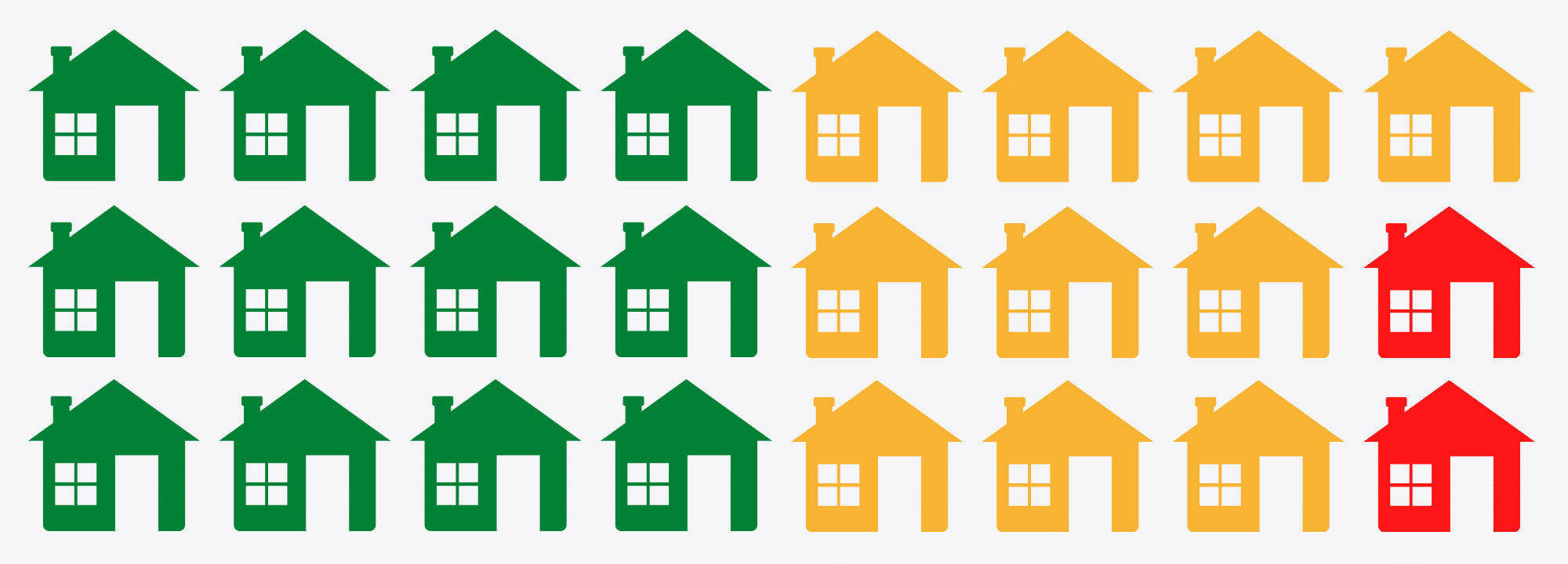

A “Traffic Light" system informs the lender as to which (approx. 50%) can go direct to mortgage offer with no physical survey, which (5-10%) clearly fall outside LTV lending rules, and which need to follow standard processes.

The Problem

For each residential mortgage application it receives, the lender must decide whether the applicant(s), the LTV and the property represent acceptable risk.

Applicant credit-checking has long been quick & automated and LTV validation has improved with AVMs.However, checking the property largely remains a manual process which very often involves a physical survey visit, then Title searches and potential PVQs.

Applications are often treated much the same and the whole process is time-consuming, resource-hungry and costly. Worse still, after wasting weeks and ££££s in processing, 5-10% of applications are later found to fall outside Lending Rules or LTV criteria and/or there are issues with the Title, so they go no further.

The Solution

The MortgageChecker App from WhenFresh changes all this. WhenFresh builds bespoke MortgageChecker Apps, tailored to reflect any set of LTV and lending rules.

As each new application comes in, the lender logs into their MortgageChecker App and simply enters the property address, the purchase price and requested mortgage amount, to instantly interrogate WhenFresh’s vast data resources via API to check whether the property meets lending rules and LTV criteria and whether there are any issues with the Title, such as the presence of a flying freehold or restrictive covenants.

MortgageChecker is then able to instantly inform the lender of how to proceed with each individual application based on a ‘traffic light’ system, BEFORE any unnecessary costs are incurred.

MortgageChecker Explainer Video:

MortgageChecker Outcome Definitions:

PROCEED DIRECT TO LEND – Where the property clearly and fully meets lending rules and LTV criteria, the lender make an immediate mortgage offer using an AVM valuation if needed, with no need for a physical property inspection/valuation.

PROCEED, SUBJECT TO STANDARD SURVEY – Where the property is a border-line pass of lending rules and LTV criteria, or where MortgageChecker identifies potential issues, the lender should “proceed with caution" using a standard or desktop survey.

BEWARE, SIGNIFICANT ISSUES IDENTIFIED – Where the property falls outside the lending rules and/or LTV criteria, MortgageChecker highlights the issue to the lender so they can make an informed decision as to whether and how to proceed before incurring costs.

Expected Outcome Breakdown:

The outcome splits vary due to differences in specific lending rules and LTV criteria, but we normally expect approximately:

50-75% Proceed Direct to Lend – no survey needed.

20-40% Proceed, subject to standard survey.

5-10% Beware, significant issues identified.

WhenFresh Data Attributes

WhenFresh has combined over 200 proprietary, private and public datasets in one place to provide physical attribute, risks, perils, geospatial, environmental, market, valuations and climate change data for virtually every residential property in the UK. Users instantaneously access the data items they need, in the format they prefer via the WhenFresh API on a pay-as-you-go basis, including: