Expenditure Data for I&E

Take a smarter, semi-automated approach to I&E and build a more accurate picture for fairer, sustainable outcomes.

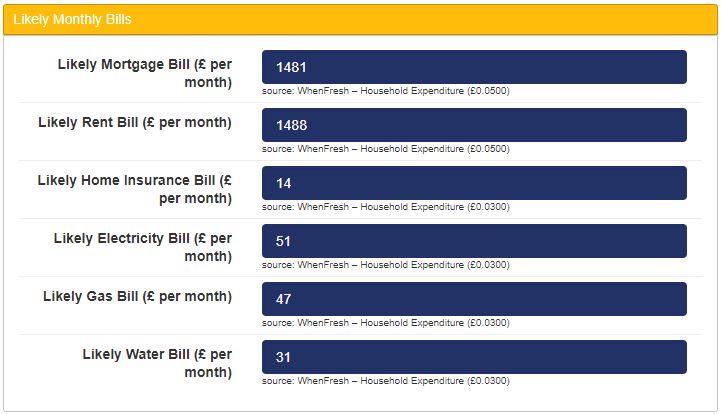

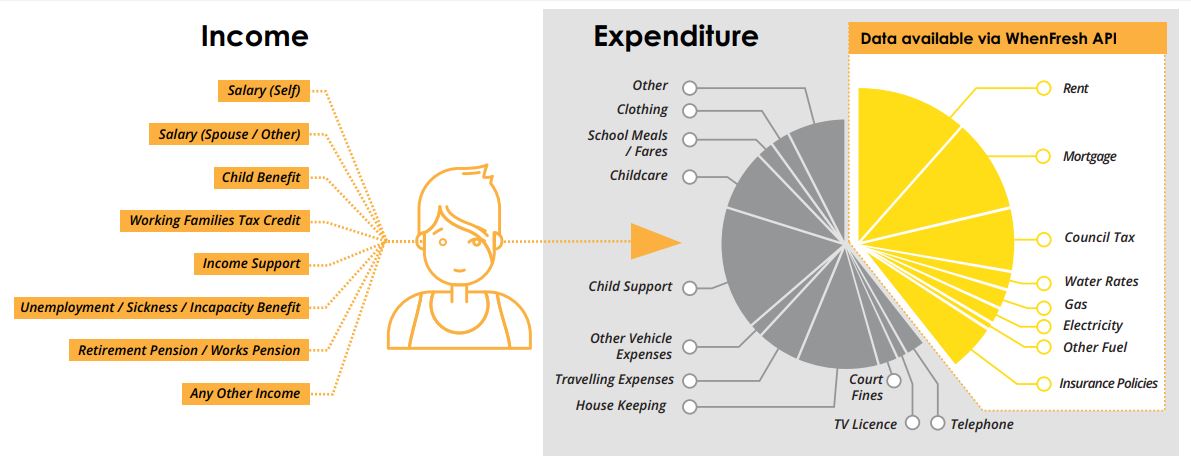

WhenFresh Household Expenditure Data for I&E provides accurate consumer expenditure values for virtually every UK household, including rent/mortgage, electricity, gas, water, home insurance and Council tax.

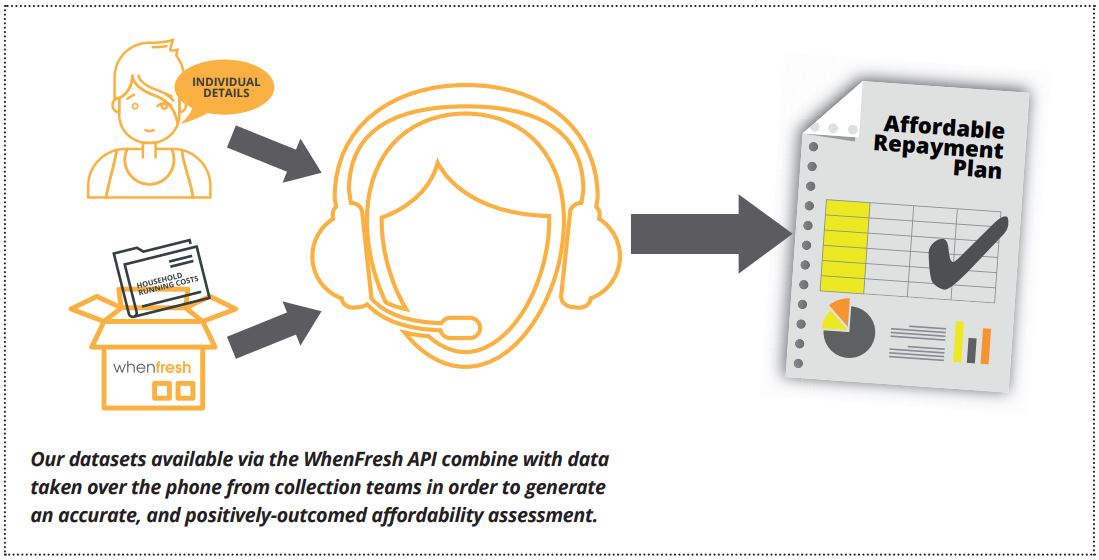

Household Expenditure data can be delivered instantly via API to complement and validate I&E information provided by consumers to help achieve affordable and sustainable repayment agreements and help achieve best practice in the eyes of Regulators.

Treating Customers Fairly (TCF), requires firms to be able to demonstrate that they are delivering fair outcomes to consumers consistently. Obtaining accurate expenditure and income information from people in difficult debt-related situations to ensure Fair Treatment can be a challenge, and of course, every case is different.

Those in vulnerable financial positions may find it difficult to provide the correct information required in completing an Income and Expenditure (I&E) assessment. This can mean they end up with an unfair payment arrangement or settlement based on inaccurate information. When I&E verification is carried out by phone, it can be a time-consuming and inadequate method for gaining valid data, particularly when recovery teams do not have the scale or infrastructure to undertake assessments efficiently or accurately. Even using online channels it is still a challenge for organisations to check and validate the information provided for accuracy.

Deficient data can cause frustration and unnecessary efforts for customers and can potentially lead to the worst possible outcome: a set of inappropriate payment arrangements, which in some cases may worsen a customer’s financial situation.

We process millions of records at household level calculating council bill payments, heating costs, water charges and insurances. We also determine accurate rental and mortgage payments which are usually the most significant expenditure and so vital to a fair payment arrangement. These costs, used alongside other related expenditure, allows collections companies & organisations to assist the customer in forming a much more accurate assessment allowing them to make repayments comfortably and on-time.

The Responsible Lending Guidelines from the FCA encourage the use of third party data and the sharing of data directly between lenders for this validation process and is a process which Ofcom & Ofgem suggest telco and utility companies across the UK follow as best practice.

Embedding WhenFresh Expenditure Data for I&E into your systems and processes helps operators to assist (and validate) customer expenditure and budgeting in real time, which brings additional benefits to those organisations that are obliged to offer help to customers who have fallen into arrears. The FCA is clear that sound affordability assessments are required to demonstrate responsible lending & operating and a breach of the FCA Responsible Lending Guidelines can jeopardise a providers credit license. For other non-regulated consumer-facing businesses, adopting the approach can result in better customer service and reduced reputational risk.

WhenFresh Expenditure Data for I&E is part of the full WhenFresh Collections Suite.

To find out more about WhenFresh I&E services, please call Paul Rout on 020 7993 5818 or complete the short online enquiry form.

Download Product Sheet

Download Product Sheet