Collections Property Data Enrichment Block

See the full picture, by enriching the book with key residential property and outgoings data, to better inform the collections strategy.

Overview

Whether you are a DCA (Debt Collection Agency), an in-house collections team or a related service provider, it has seldom been more challenging to differentiate the WOULD from the COULD, the CAN’T from the WON’T… and everything in between.

The debt amount(s), payment performance and other transactional factors are known – and credit data can be readily purchased from the credit reference agencies – but this only gives part of the picture.

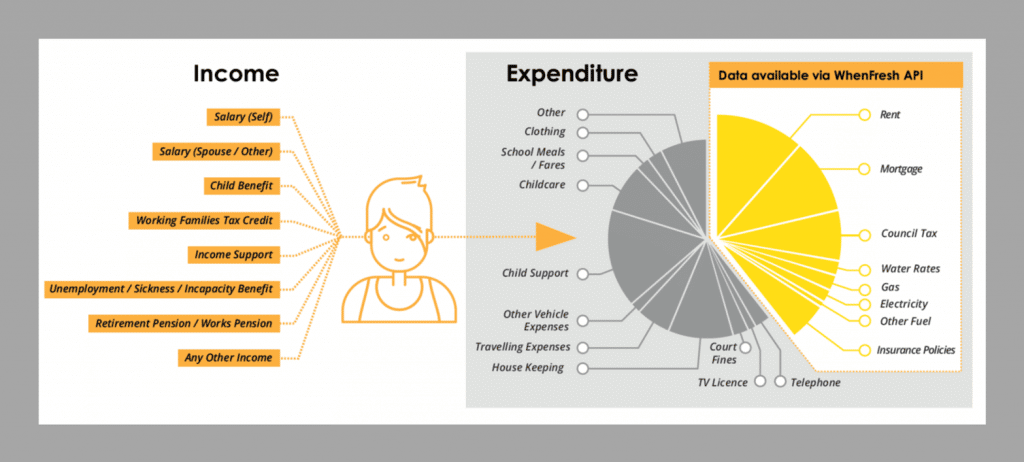

Appending the WhenFresh Collections Property Data Enrichment Block to the book provides instant, up-to-date insights on the property and key outgoings, to inform the debt purchase and collections process better than ever.

Drawing on the vast breadth and depth of residential property data we hold, WhenFresh can tell you:

> Is the property a wholly owned or mortgaged asset – or is it a private or social-housing rental?

> What are the likely rental or mortgage payments?

> What is the value, shape and size of the property – does this match with what has been declared?

> What are the likely Council tax, electricity, gas and water outgoings for the property?

> Is the property listed for sale or rental – i.e. is there a potential flight risk? And much, much more…

The WhenFresh Collections Property Data Enrichment Block gives you the means to see a much fuller picture, in order to focus appropriate, timely levels of collection activity across your portfolio or deliver insight for a potential debt purchase, optimising collections outcomes.

Product Description

Obtaining accurate financial information from people in difficult debt-related situations to ensure Fair Treatment can be a challenge. It is important to obtain accurate information on the location, financial situation, and key details of a debtor to enable the correct assessment in view of recovering the debt.

Through the use of up-to-date and verified information, from the UK’s largest property information bureau, WhenFresh has produced a collections data block which can integrate seamlessly with your existing practices and help you better understand the debtor’s situation and the best approach for debt recovery.

The Whenfresh Collections Data Enrichment Block

The WhenFresh Collections Property Data Enrichment Block has been compiled to provide debt collections teams with key insights on properties and outgoings and includes the following:

| DATA VARIABLE | APPLICATION |

|---|---|

| Property Use | Validate whether the property has residential or commercial use. |

| Multiple Occupancy | Does the property have multiple occupancy 3+ (HMO) family units. |

| Social Housing | Is the occupant a social housing tenant. |

| Dwelling Description | Type of dwelling, e.g. a detached house, a flat or just a room. |

| Property Type | Type of property, e.g. a semi-detached house, terraced house or flat. |

| Bedroom Count (1 to 5+) | How many bedrooms does the property have? Does the space match the reported number of family members or expected levels of household running costs? |

| Council Tax Band | Confirmation of the Council tax band of the property. |

| Likely Mortgage Bill (£ per month) | What is the estimated monthly mortgage payment for the property, for comparison with the amount that has been declared. |

| Likely Rent Bill (£ per month) | What is the estimated monthly rental payment for the property, for comparison with the amount that has been declared. |

| Likely Water Bill (£ per month) | What is the likely monthly expenditure on Water for the property, for comparison with the amount that has been declared. |

| Likely Electricity Bill (£ per month) | What is the likely monthly expenditure on Electricity for the property, for comparison with the amount that has been declared. |

| Likely Electricity Consumption (kWh pa) | What is the likely annual expenditure on Electricity for the property, for comparison with the amount that has been declared. |

| Likely Gas Bill (£ per month) | What is the likely monthly expenditure on Gas for the property, for comparison with the amount that has been declared. |

| Likely Gas Consumption (kWh pa) | What is the likely annual expenditure on Gas for the property, for comparison with the amount that has been declared. |

| Likely Home Insurance Bill (£ per month) | What is the likely expenditure on home insurance for the property, for comparison with the amount that has been declared. |

| Property Value: Virtual Survey Estimate (£) | How much is the property worth and how much equity could be available for recoveries activity? |

| Property Value: EPM (£) | What price would the property be likely to achieve in a 90 day ‘fire sale’ and would it meet expected equity levels? |

| Rent Market Statistical Mode Price (£) | What is the estimated current rental price for the property, for comparison with the amount that has been declared. |

| Rent Market Statistical Certainty | Indicates the degree of confidence/certainty of the estimated rental price. |

| Rent Paid £ (at latest rental date) | The rent paid when the property was last rented, for comparison with the amount that has been declared. |

| Date Property Last Listed as Rented | When was the property last rented, for comparison with the move-in date that has been declared. |

Delivery Options & Costs

Delivery is made either in bulk via data appendment to a flat-file of addresses you supply (turnaround usually 2-3 business days) or via a set number of live lookups of the data block described above, via a single, simple integration with the WhenFresh API. Costs are dependent volume and additional data items selected. Please contact Paul Rout on (+44) 020 7993 5818 or paul.rout@whenfresh.com for details.

Detailed Data Item Descriptions:

> Property Valuations

Our property valuation solutions have a track record within the financial services space within the mortgage originations. The valuation solutions have also been used in collections and recoveries valuations to support equity calculations for debt recovery and litigation assessment.

Our property valuation solution comprises 2 models to deliver increased accuracy and flexibility around application:

- Virtual Survey Estimate (VSM) – market value of the property

- Estimated Price Model (EPM) – 90 day fire sale value of the property

- Confidence measures

All of our valuation solutions are fully tested have an accuracy rating of 99.4% accuracy, as compared against price paid data at HM Land Registry.

> Rental Value Solutions

Our rental valuation solutions are used by estate agents, lender buy-to-let assessment, yield and income calculations and central government fraud identification. In the collections space rental solutions are used to assess and validate affordability.

Our rental valuation solutions use data from a number of sources including listings, landlord insurance and tenant vetting.

We have a dynamic pool of circa 3.5 million actual rents which is modelled using the same methodology as our sales valuation to provide full coverage over the UK and to keep historical rents up to date. Our rental value solution includes the following:

- Rent Paid

- Current Rental Valuation (Actual and Modelled)

- Historic Rental Valuation

- Confidence measures

> Home Movers and Transactions

Our property transactional data and analytics is used to validate and identify changes in individuals’ circumstances, covering both house sales and rentals of up to 2 million moves per year in the UK

The data identifies home movers, tenure (owner or tenant) and transactions value, we know about the timing of a move both for current and historical transactions

The information has been used in the collections environment to identify flight risk (pre-trace), void properties, council tax non -payment, landlord driven fraud and tax liability within a number of local and central government applications.

> Property Attributes and Household Expenditure

Our property attribute and household expenditure data provides organisations real insight into an individual’s circumstances and has been used to assess vulnerability, affordability and validate household composition across collections and fraud applications, specifically to:

Our property attribute and household expenditure data provides organisations real insight into an individual’s circumstances and has been used to assess vulnerability, affordability and validate household composition across collections and fraud applications, specifically to:

- Identify complex residential units and vulnerability

- Support affordability – Income and expenditure

- Identify household composition & benefits fraud

The solution has a range of property attributes for the UK including:

- Property use, Occupancy type & tenure

- House of multiple occupancy, social housing and institutional indicators

- Number of rooms & living space – bedrooms etc.

- Running costs & Property use and classification

For more information on the WhenFresh Collections Property Data Enrichment Block or to arrange a call/demo, please contact Paul Rout on (+44) 020 7993 5818 or paul.rout@whenfresh.com or complete our short enquiry form.

Optional Additional Property Bureau Information

In addition to the standard block detailed above, Whenfresh can also provide a further range of property-based information to provide further insights into current circumstances and potential changes. These solutions have been used in the collections space to:

- Identify flight risk by by monitoring portfolios for home moves

- Identify home ownership for litigation strategy.

- Provide legal information and documentation for litigation execution.

> Additional Property Bureau Variables

| DATA VARIABLE | DESCRIPTION |

|---|---|

| Ownership Verification | Provides confirmation of property ownership and details such as joint or sole ownership etc. |

| Full Sales & Rental Transaction Information | Summary of the sales & rental history or the property. |

| Market Status Service (Trigger Monitoring) | A trigger-based service to monitor the portfolio and flag whether & when properties are on the market for sale or rent. |

| Number of Charges | Count of charges present against the property. |

| Detailed Property Charge Information (per Date/Organisation) | Details of charge holder(s) and date of charge(s) relating to the property. |

| Restrictions – Detailed Information | Title restriction(s), holder date(s) and restriction(s) relating to the property. |

| Personal Covenants – Detailed Information | Title personal covenant(s), holder date(s) and covenant(s) relating to the property. |

| Restrictive Covenants – Detailed Information | Title restrictive covenant(s), holder date(s) and restrictions(s) relating to the property. |

| Title Deed – Office Copy | PDF copy of the property Title Deed |

> Collections and Recoveries use cases

- Debt Management & Recovery (Litigation)

- Change in circumstances

- Expenditure Validation & Fraud

- Enhanced Tracing

- Vulnerability – Identification of occupants of HMOs, Social Housing, Institutional Housing

- Change of Occupier

- Household Composition

- Empty Properties / Voids

To find out more about these additional data variables WhenFresh can supply, please contact Paul Rout on (+44) 020 7993 5818 or paul.rout@whenfresh.com or complete our short enquiry form.